BPMN MIWG capability demo is back! Again, we will be showcasing the interoperability of BPMN diagrams. This time our capability demonstration will not be a part of the Object Management Group conference, but it will be a standalone (online) event on July 18th, 2024 at 04:00 PM CEST.

UPDATE: below you can see the YouTube recording and additional info about our demonstration.

What to expect from this edition of our capability demonstration? As always, were working together on a set of BPMN diagrams to show that different process modeling tools can work together seamlessly thanks to the BPMN XML – shared diagram interchange format.

This year, we covered more advanced elements of the BPMN specification:

- Boundary events

- Call Activities and

- Event Subprocesses

Our demo scenario is based on a process of handling credit application.

Recording of the event

Event started by introduction by Denis Gagné (chair of the BPMN MIWG). Denis introduced our group and companies participating in the demonstration, told about the importance of BPMN Interchange, and provided overview of what will be presented during the session and how it will all work.

You can see the slides below:

Around 7:30 Denis introduces first colleagues, who will be doing the modeling: Björn (from MID), Timotheus (from SAP Signavio), and Mattia (from ESTECO).

Now few things that may help you follow the event a bit easier. Since we are working on 3 different diagrams in parallel you can see how each participant performs his part and leaves, so that following person can import the diagram that was created, add more elements, export it and so on. In the video you can see how Denis acts as DJ switching between our screens to show you the most interesting parts.

For example: Björn’s part is from 7:55 when you see his start page with cute panda (by the way – the process architecture you can see is not part of the BPMN standard) and ends on 9:10 when you can see Timotheus with the part of the model he already created in the background. Timotheus finishes on 10:07 and Mattia takes over and starts modelling the third process from the start. His parts ends on 11:37 and Niall (from Camunda) takes over the model started by Björn. And so on 🙂

The tool part lasts till 25:58 when last part was finished by Simon (from Trisotech). In the last few minutes Denis provided summary of the event and introduced all participants to show again, so that you could see (nearly) all of us at once.

Each of us tried to provide a context of what we were doing, so you can watch the video above or if you prefer read the description below where I write what is happening in each process shown during the demo.

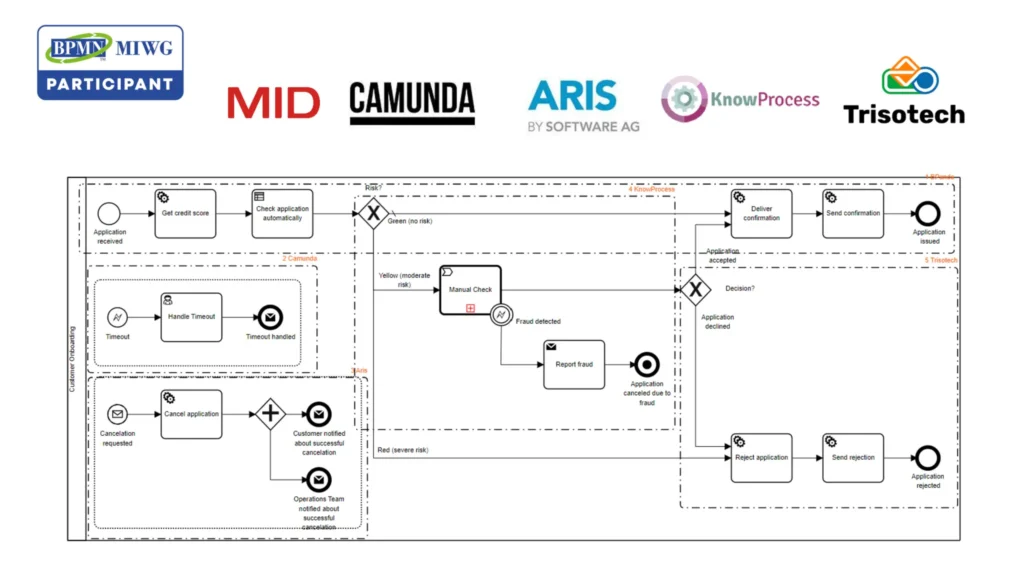

The main process (Customer Onboarding) was created by colleagues from: MID (with tool BPanda), Camunda, Software AG (ARIS), KnowProcess, and Trisotech.

As you can see, the logic is pretty clear: after the application is received, a credit score is automatically checked and business rules are used to decide how this application should be handled.

Safe applications get automatic confirmations. Very risky applications are automatically rejected. Cases that are not obvious require a manual check, which can lead to acceptance, rejection, or special handling for fraud.

In case you are wondering: originally when we planned to show automation as a part of this demonstration, there was also some DMN used in this business rule task, but finally, we decided it would take too long and participants would not be very happy.

Apart from the main flow of the process, we also have two event subprocesses used for handling timeouts and cancellation requests.

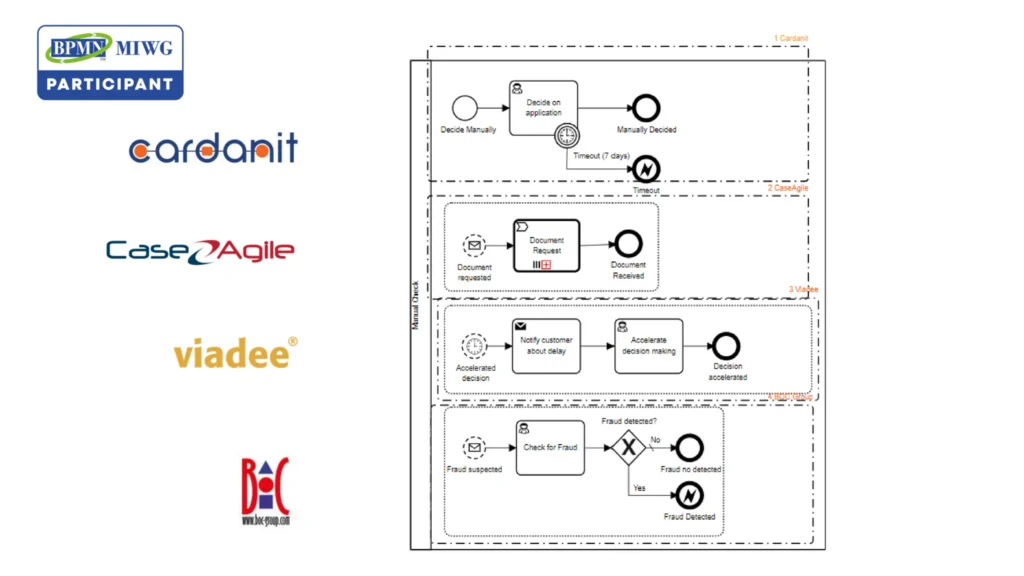

Now, it’s time to see what happens inside the “Manual check” diagram referenced from the Call Activity in the main process.

Manual Check process was created by: Cardanit (by ESTECO), CaseAgile, viadee, and BOC Group (with yours truly and ADONIS 🙂 ).

The main flow is pretty easy: the employee needs to decide on the application. If it does not happen within 7 days, there is a timeout thrown. Yes – it is the same timeout that is handled in a main process.

However, that is not all. Apart from the main flow, we also have three event subprocesses (all non-interrupting). The first one deals with requesting documents. We will return to it in a second, since this Call Activity also has its own diagram.

The second one is meant to handle situations when we need to speed up a bit.

The last one (my favorite) is about fraud handling. If fraud is detected, an error is thrown. As you may expect, we will handle it with the boundary event “Fraud detected” in our main diagram.

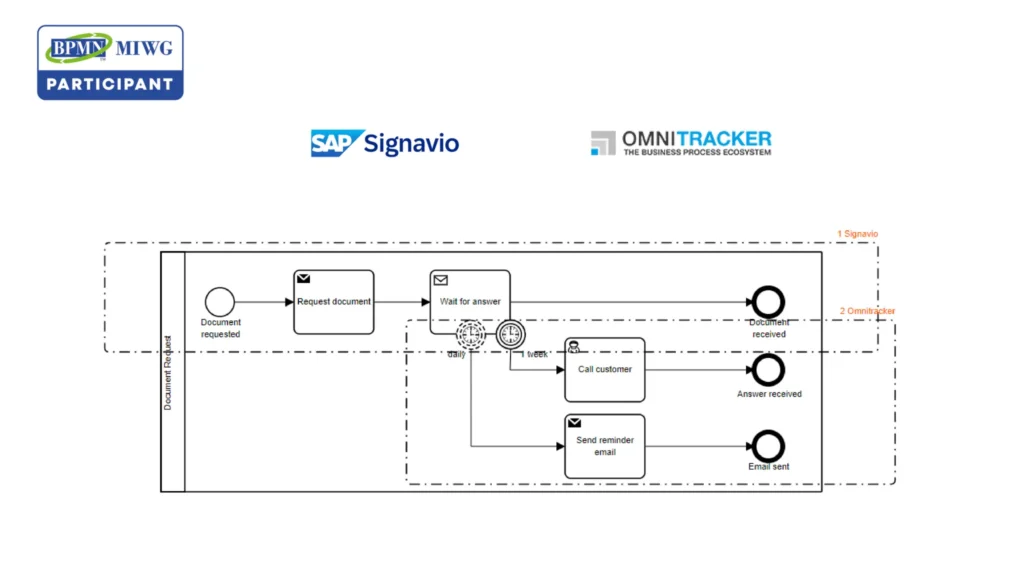

Last but not least, the final diagram – Document request. It is the smallest one, so there were only two vendors involved: SAP Signavio and Omnitracker.

We do not have any event subprocesses here – only boundary events. The main flow is simple: when we need the documents, they need to be requested, and then we wait for an answer. Ideally, we get the documents and the process can finish. However, some customers may not deliver them right away, so we need the boundary events: one sends a daily reminder and the other triggers a call the customer after a week (we assume optimistically that it will suffice).

And that’s it 🙂 If you have any questions about this event or the models we created let me know in comments.

As in the previous cases, after the demo I will also add more details to this post plus embed a recording.

If you want to see the diagram interchange live plus have a chance to ask questions to the members of BPMN MIWG register for the live event: https://streamyard.com/watch/dAGGy6KFzb9Y